Complete Guide to Cannabis Payment Processing Solutions

Sifting through your options of payment processing solutions for your dispensary can be overwhelming and confusing. This blog will guide you with an overview of all of the cashless payment options available to cannabis dispensaries today, how they work, and how TreezPay can connect you with those options.

Moving toward a cashless society

As the world swiftly moves into a more digital era, the use of physical cash in our everyday lives has become less and less frequent. A survey performed by Travis Credit Union found that fewer than 16% of respondents said that they always carry cash, and that when Americans do have cash in their wallets, it only averaged to about $46 among all respondents. Data from Fundera reveals that a majority 80% of Americans preferred to pay for goods with credit or debit cards, and only 14% preferred to pay with cash. Their top reasons for using cards over cash were convenience, security of the transaction, and hygiene.

In industries across the board, small businesses now take the bulk of their revenue with cashless methods. According to a report by the Mercator Advisory Group, card payments accounted for an average of 50% of small business total sales, checks accounted for 30.1%, 10.3% for other payment methods, and only 36.4% of those sales were in cash.

The spread of Covid-19 in recent years has also caused major coin shortages, and has further pushed consumers to use less cash in buying goods and services.

The data doesn’t lie, commerce and consumer preferences, whether it be digital or in-person, are moving towards cashless convenience.

Contactless vs. cashless payments

First, let’s establish the difference between cashless and contactless payments. As the word suggests, cashless payments are payments that are made without the use of cash. These payment types include bank transfers, credit card payments, mobile payments and payments made with digital wallets.

Contactless payments are credit cards that use either near-field communication (NFC) or radio frequency identification (RFID). These technologies are built into most credit cards today, and work by waving the card over a reader to complete a transaction. Digital wallets can also be used for contactless payments.

Which payment processing solutions are available for cannabis purchases today?

- Debit card payments are directly linked to a user's bank account and usually require a unique PIN (personal identification number) to complete a transaction. Funds for collecting debit card transactions are usually processed within 24 hours of the completion of a transaction.

- Digital wallet payments are contactless payment methods that store your payment options such as debit or credit cards in your smartphone. Some digital wallets like Apple Pay and Google Pay use NFC technology, while others like Samsung Pay use MST (magnetic secure transmission) technology to communicate with card readers or payment processors. Not all digital wallets friendly to working with cannabis retailers, including Paypal.

- ACH payments, also called EFT payments, use a financial network in the United States to transfer funds directly from one bank account to another without using paper checks, credit card networks or wire transfers. If you pay your bills electronically or receive direct deposits, it is most likely using the ACH network. Funds from ACH or EFT payments usually become available in 3 to 5 business days.

- Cashless ATM payments also known as point-of-banking rely on the existing payment networks to pull funds from a debit or credit card using a four digit pin. The transaction works similarly to withdrawing funds from a physical ATM, but skips the step of actually pulling physical cash from a machine. The transaction shows up on the customers’ bank statement as an ATM withdrawal. Funds for cashless ATM transactions usually appear within 3 days. Although this has been a popular payment processing solution for dispensaries, there are potential fees and risks involved.

- Cryptocurrency payments - use block chain technology to securely transfer traditional currency into digital currency. However, there is very little existing technology available to cannabis retailers to make it easy for their customers to pay for their purchase with crypto.

Which payment processing solutions are not currently available to cannabis retailers?

- Credit card payments are not currently available to cannabis retailers due to the current classification of cannabis as a federal illegal substance. Because of this, the risk of penalization is simply too high for credit card processors like Visa, Mastercard and AMEX to work with any business directly producing or selling cannabis. Warning - if any company promises a solution to process credit card transactions for your dispensary, they are in all likelihood doing so fraudulently.

What are the pros and cons of each cashless payment processing solution?

Debit card payments

The use of debit cards are extremely popular among consumers, accounting for 28% of all payments in 2019 according to the Federal Reserve. Integrating the use of debit card transactions in your dispensary is incredibly valuable.

TreezPay customers using integrated PIN debit typically see an increase of $10 - $20 in ticket value per transaction.

PIN debit transactions also incur less in fees than other payment processing options. The fee for purchases made with PIN debit is a small percentage of the total transaction value. These fees are automatically passed on to the end consumer as an added benefit to your dispensary. It is also the fastest payment processing solution in terms of getting funds into your account, with a 24 hour turnaround time on average. Additionally, if a customer has a debit card loaded into their digital wallet, Treez Pay PIN debit terminals are also able to process contactless payments through a debit card. Another advantage with PIN debit is that you don’t have to make change for the transaction, like with a cashless ATM solution.

The only con of using debit payment processing at your dispensary is that the fees for a transaction over $100 can surpass other payment processing types.

However, TreezPay processing payment solutions do not have any exclusivity built into each product, so you’re able to combine PIN debit with other solutions.

Overall, this is one of the most convenient payment processing options you can offer in your dispensary to boost your revenue and facilitate a better customer experience.

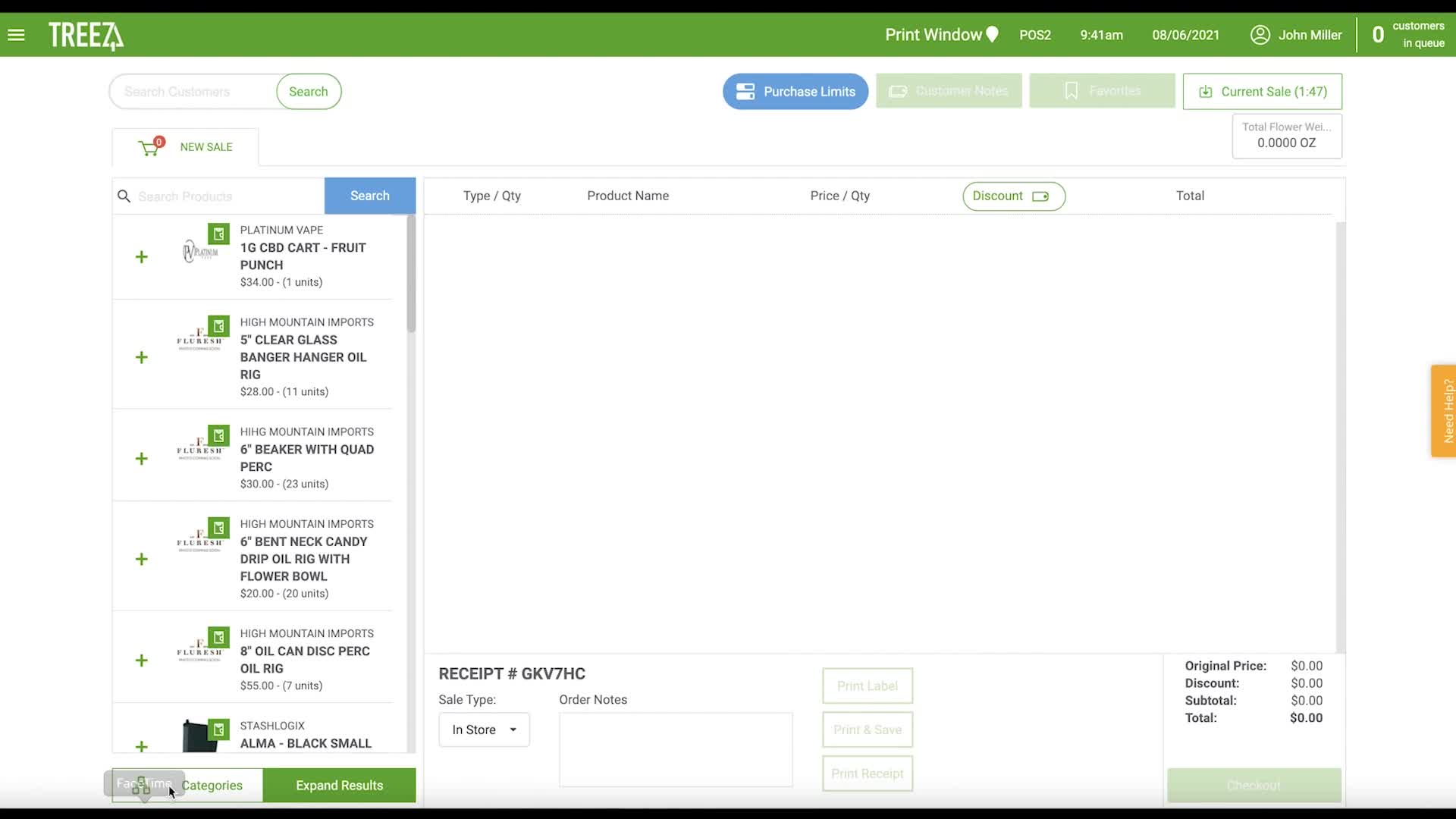

View a demo of TreezPay PIN Debit in action below:

ACH / EFT payments

ACH payments, also known as EFT payments, can be incredibly valuable in boosting your dispensary revenue, especially in terms of e-commerce. ACH payments connect to your online menu, and allow your customers to securely link a checking or savings account to pay for their transaction. Currently ACH payments work with the Treez e-commerce menus, Weedmaps, Jane, Tymber and others.

Because your customers are only limited by the funds existing in their account, orders placed online and paid for through ACH typically are $40 higher on average per transaction.

Another benefit of using ACH payments for your delivery and order ahead is that this solution does not require that you purchase additional hardware to work. ACH funds typically take about 3-5 days to deposit into your account.

The only downside to ACH payments currently is that this solution only works for your e-commerce experience and not in-store. However, we recommend combining ACH with other payment processing solution options, and is definitely a powerful and convenient solution to add to your tech stack.

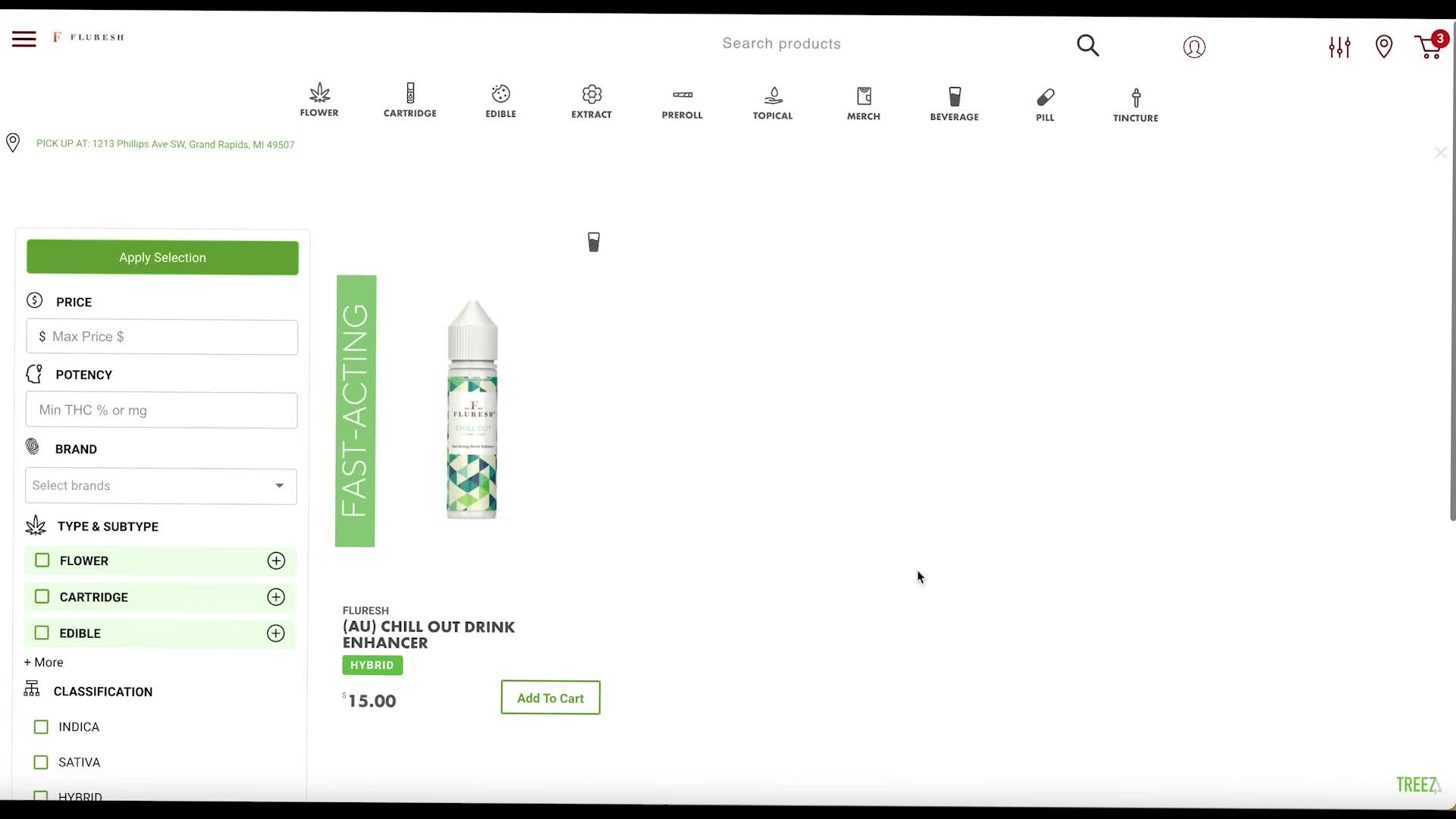

View a demo of TreezPay ACH in action below:

Cashless ATM / point-of-banking payments

Cashless ATM transactions were the first alternative payment processing solution available to dispensaries and have been traditionally used for many at risk businesses. Although it is widely used for dispensaries, Visa issued a warning in December 2021 that the use of cashless ATM’s as a way to purchase goods and services without the direct use of cash is in violation of their policies. Although the announcement does not mention the use of cashless ATM in the cannabis industry specifically, and it is currently unclear how Visa will exactly enforce its rules around the use of cashless ATMs One drawback of using a cashless ATM are the fees. Fees per transaction of cashless ATM start at around $3 per transaction, however those can vary depending on the cashless ATM service provider. Additionally, transactions are rounded up to increments of 10, so if the total price of a ticket is $16, the transaction is rounded to $20. Many dispensaries give back the difference to customers in cash.

Funds usually become available from cashless ATM transactions within 72 hours.

Cashless ATMs have been widely used by many dispensary operations, and is still an option for cashless payments. However, due to the drawbacks of cashless ATM we recommend utilizing other payment processing solutions like PIN debit or ACH in parallel to your cashless ATM.

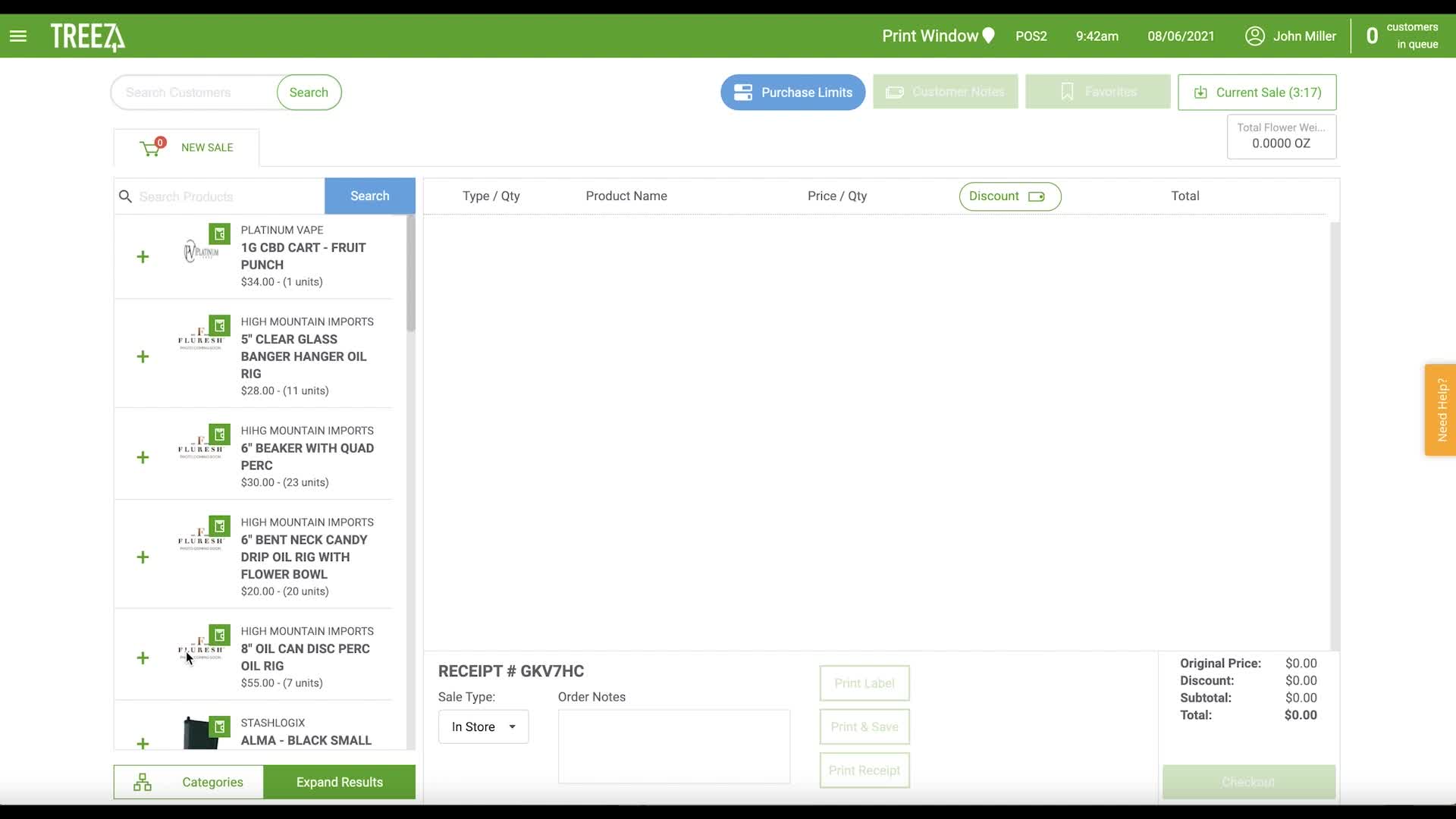

View a demo of TreezPay Cashless ATM in action below:

Which payment processing solution is best for my dispensary?

The best payment processing options for dispensaries today are PIN Debit and ACH. These solutions are the most reliable, safe, and have the lowest fees. The good news is that Treez Pay offers both of these options for your dispensary, and these solutions are integrated with our SellTreez point-of-sale solution to make your transactions as smooth, and efficient as possible. The integration between SellTreez and TreezPay products also significantly reduces errors when collecting payments, making it much easier on your accounting team to keep your books in check.

How to get started with TreezPay

The average dispensary sees a 40% increase in average order value, and a 10% increase in revenue year over year after implementing TreezPay solutions.

If you’re ready to boost your revenue and create a more convenient way for your customers to pay for their cannabis products either online or in-store, the Treez team is ready to help. Contact us today for a no-obligation demo, including a free customized quote and an estimate for the return on investment you’ll get after implementing TreezPay.